SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines — Filipino time, ningas kugon, colonial mentality.

We hear these phrases often – when a colleague arrives late for a meeting, when a subordinate fails to deliver on a project he was so eager to take at the beginning, or when a friend buys an imported brand even if the local counterpart is better in quality and cheaper.

We refer to these as “ugaling Pinoy.“

These habits hold us back in school, work, in our relationships, and even financially.

Are you guilty of any of these habits? Now is the best time to get rid of them.

‘Mañana’ habit

Mañana is the Spanish term for tomorrow and it sounds like “mamaya na,” which means “later.” Filipinos usually use this phrase to refer to the habit of procrastination.

Financially, it’s perfect to describe lack of preparation for the future. Many Filipinos put off saving or getting insurance, feeling they can do so on another sunny day or when their finances are more stable. When they finally decide to do it, it’s too late – the premiums are too high or they’re sick and need the money badly.

Most Pinoys also forego saving for retirement. Instead, they spend all their money on their children, believing that when they get old, the favor will be returned to them. This is the same burden that their own parents imposed on them. It becomes a vicious cycle.

When it comes to accumulating wealth, the best step is to start early. Don’t put off for tomorrow what you can do today.

‘Bahala na si Batman’

“Leave it up to Batman” sounds like a quip from an ‘80s action flick, and yet we still hear this phrase getting thrown around everyday.

When you get your pay, it’s easy to get caught up in the moment, spend on things especially when they come with the enticing 70% off tag. You end up spending most of your budget in one go, without setting aside an amount for your savings account.

What if you or a family member gets sick? You should have an emergency fund for surprise expenses like hospitalization.

‘Hiya’ factor

Sometimes, Pinoys are too humble — to a fault. We are hard-wired to avoid talking openly about our wealth or the desire for it.

This hesitation stems from our childhood – in the classroom, many students are afraid to ask questions because they might be ridiculed or perceived as overly inquisitive. In playing safe, we miss out on the opportunity to learn more.

When it comes to financial wealth, you can never ask too many questions. To make wise money decisions, the best step is to share your financial goals with someone who can give sound, practical advice.

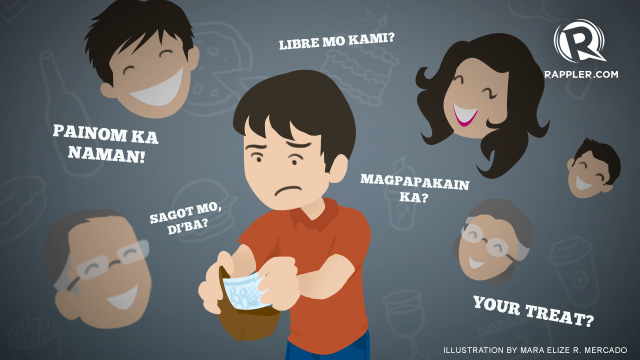

‘Pakikisama’ and ‘Libre!’

Birthdays, promotions, anniversaries, christenings — if there’s any reason for celebration, Filipinos are bound to milk it.

When put on the spot, we tend to prioritize the happiness of other people over our own financial well-being.

Everyone loves a treat, and getting the tab all the time can make you the most popular person. But is it always necessary to eat out for every single milestone and make that unscheduled trip to the ATM just to put on a good face?

Because of pakikisama, or our cultural predisposition to get along with everyone, we find it hard to refuse when a relative or a close friend needs financial aid.

We end up shelling out our own savings because we’re afraid to say “no.”

There are times when it’s necessary to say, “I’ve got this.” But when you really don’t, you have to be honest. Trust your peers to understand, as they’re probably in the same boat.

’Okay na yan’

Some people have the tendency to go “Okay na yan” (that’s good enough) when assessing their performance or status. They are reluctant to challenge the status quo and shake things up.

Why settle for okay when you can have the best option? Why should you be satisfied with achieving your minimum savings goal when you can actually aim higher and take simple steps to be more prosperous?

You can start by opening a time deposit or mutual fund account, depending on what suits you. Over time, these products can help your savings earn more.

There’s no such thing as being too prepared. Having more isn’t just for your stability, but for the well-being of your family.

The truth is that Filipinos have a lot of positive traits; we are hardworking, resilient, and optimistic. Financially, we are all equipped to make the best happen, if we just put our heart and soul into it.

But if you’re guilty of any of the bad traits, check yourself. Start correcting these habits before they define your future. — Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.