SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

People are more conscious of their health nowadays.

They engage in various sports to improve their physical health. Why? It prolongs life, strengthens the immune system, and lowers health risks like cardiovascular diseases, not to mention improved work performance and general well-being.

But physical wellness is only one facet of your well-being. There is also the financial aspect as well. The question now is, are you financially fit?

Or are you financially unfit?

Like – are you overweight with credit card balances or unnecessary things you bought?

Are your finances weak – that one major tragedy can bring them to shambles?

Or perhaps there is no financial flexibility such that you can enjoy life’s little luxuries?

These hinge on proper money management and thus, being financially fit is very important. How do you start that? Here are 5 ways to help you become financially fit:

Prioritize your budget

Your cash flow is the resource to fund your present and future. It is therefore very critical that it remains healthy. You do this by making a budget. Remember: your budget reflects your priorities. If you allocate first (and more money) into gadgets, shoes, or any other expenses before your children’s college fund, or your retirement, what does this say of your priorities?

Case in point: Back in 2012, my in-laws wanted us to spend the holidays in the US. At the same time, I wanted an iPad. My deal with my wife then was that I shall only buy it after I have made the money needed (plus pocket money) to go to the US without touching our 6-month emergency fund, plus still funding our other investments. Well, money was made and I bought my tablet after fulfilling first all the priorities.

Lose unnecessary expenses

This does not mean banishing life’s enjoyments: it’s about allocating money first to needs, and after, allocate to the wants or the “nice-to-haves.”

The trick is to separate your expenses into two parts. The first part reflects the “needs” or the fixed expenses like electricity, water, transportation, tuition, groceries, investments for education, retirement, and other required expenses.

The second section is the “wants.” This is where dining out, travel, shopping, and other items which you can really live without.

Allocate your budget first on the “needs” and work your way down to the “wants.” Thus, the gadgets, bags, expensive coffees, and eat-outs shall receive whatever is left in the budget.

Build up your investments

For most of us, when retirement hits, that is it: the money stops. We only receive pension and retirement pay which, by the way, does not really amount to much, considering the expenses that we face during retirement.

So, when do we start building up funds for retirement? No other time than now because starting off early, even with small amounts, means millions in the future.

This is also true with all other goals: start them off today so you would not have to be stressed putting off more money into more risky assets in the future.

List your goals and start investing to achieve them. A financial planner can help you determine how and how much. As they say, you build your tomorrow today.

Back up with insurance

Be ready for disaster – it can be an accident, disease, and yes, death.

This can impair the family’s ability to generate income or deplete resources entirely. That is why insurance acts as a back-up – a safety valve if you may call it, for such times.

Just the other day, I was almost hit by a truck. Luckily, I was safe. But I felt safer knowing that I have insurance enough to cover my family’s needs and my children’s future tuition for many years.

Develop financial flexibility

Life is generally unpredictable. Thus, given our limited budget, our finances should be flexible enough to answer for any needs that may arise.

Thus said, our cash flow should be positive, and investments and emergency accounts are set up so just in case downturns happen, we have resources at our disposal, anytime.

Sports enthusiasts have professional coaches to help them keep and stay fit. Similarly, you can also have a financial coach through a professional financial planner who is objective, reputable, and knowledgeable.

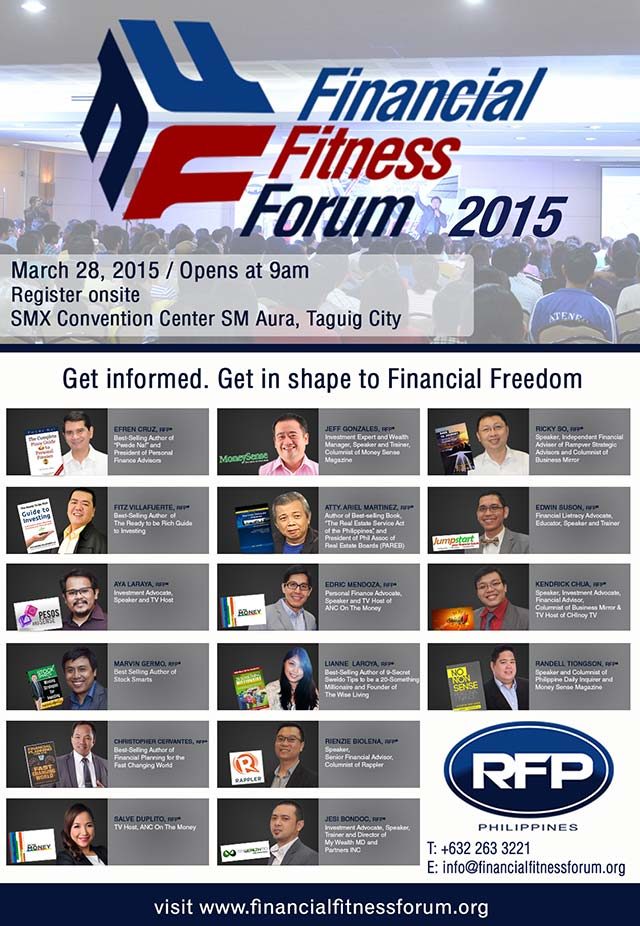

You can know more about being financially fit and meet financial planners at the Financial Fitness Forum on Saturday, March 28 at the SMX Convention Center, SM Aura, Bonifacio Global City, Taguig City. Visit http://financialfitnessforum.org/ to know more. – Rappler.com

Rienzie is a Registered Financial Planner of RFP Philippines. He is also an accredited investment fiduciary of Pennsylvania-based fi360 and an international member of the Financial Planning Association, the largest association of financial planners in the US. You may reach Rienzie at rienzie.biolena@gmail.com, his Facebook account or Twitter @rbiolena.

Rienzie is a Registered Financial Planner of RFP Philippines. He is also an accredited investment fiduciary of Pennsylvania-based fi360 and an international member of the Financial Planning Association, the largest association of financial planners in the US. You may reach Rienzie at rienzie.biolena@gmail.com, his Facebook account or Twitter @rbiolena.

Piggy bank image via Shutterstock

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.